Tech stocks plunged for the second day in a row after Donald Trump’s stunning presidential victory, a selling spree that engulfed big names like Google, Apple and Facebook.

The SV 150 index of the Bay Area’s 150 largest tech companies tumbled Thursday, which was in sharp contrast to the Dow Jones Industrial Average, which was flirting with record highs again.

The broad-based S&P 500 rose and the tech-focused Nasdaq plummeted.

Analysts offered plenty of theories about the troubles for the tech sector.

One theory: Tech stocks have been on a great ride so far this year. It simply might be time for investors to take profits in their tech shares.

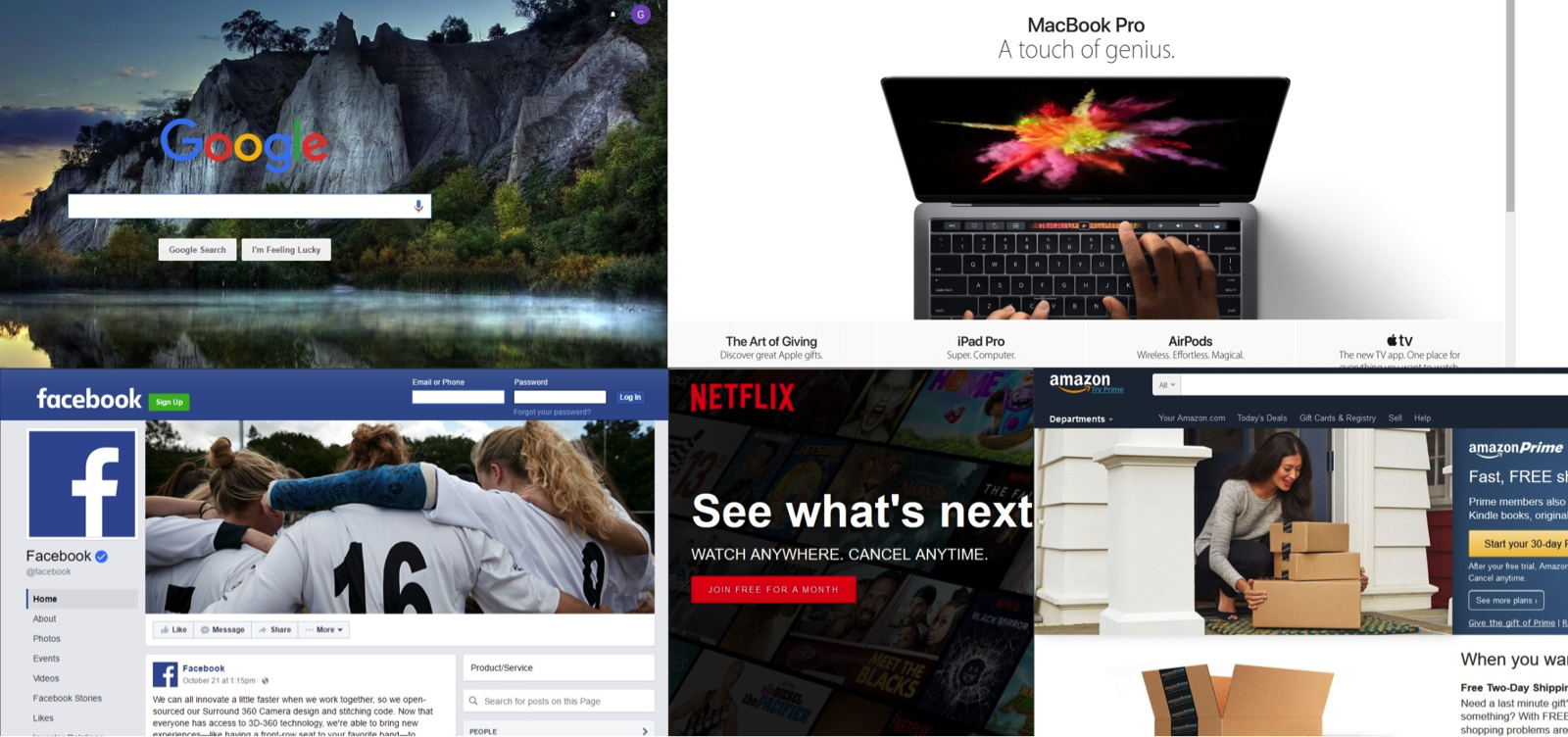

For 2016 through the end of trading on Election Day, here’s how the Bay Area’s five largest tech stocks performed: Apple was up 5.5 percent, Google owner Alphabet had gained 4.4 percent, Facebook had soared 18.7 percent, Oracle had jumped 7.3 percent and Intel was up 0.8 percent.

Two other notable tech stocks also had stellar years through Tuesday: Amazon had gained 16.6 percent and Netflix had rocketed 8.7 percent higher.

Tech may be seeing opportunities and perils alike from Trump’s triumph, according to Scott Kessler, an analyst with CFRA Research.

– We think a Donald Trump presidency coupled with a Republican-controlled Congress makes his proposal for a ‘repatriation of corporate profits held offshore at a one-time tax rate of 10 percent’ as much more likely,” Kessler said in a research note about the election results.

– We see many large U.S. tech firms potentially benefiting, with increasing domestic growth investment, stock buybacks, and dividend payouts.

There’s a “but” in the Kessler analysis, however.

– We note that Trump’s hard stances related to trade could negatively impact the tech sector,” Kessler warned.

In 2015, tech companies captured about 58 percent of their revenue from non-U.S. sources. In contrast, S&P 500 companies derived an average 44 percent of the revenue from overseas sources, Kessler estimated.

Trump during the campaign suggested that Amazon might have an antitrust problem.

– Amazon is controlling so much of what they are doing,” Trump said in an interview with conservative commentator Sean Hannity.

Trump raised concerns that Amazon’s success has undermined the prospects for traditional brick-and-mortar retailers.

The president-elect also was unhappy that Amazon Chief Executive Jeff Bezos owns the Washington Post, which during the election campaign launched investigations into Trump and harshly criticized the businessman.

What’s more, Silicon Valley, with the notable exception of venture capitalist and entrepreneur Peter Thiel, was almost universally, and publicly, opposed to Trump.